ASEAN

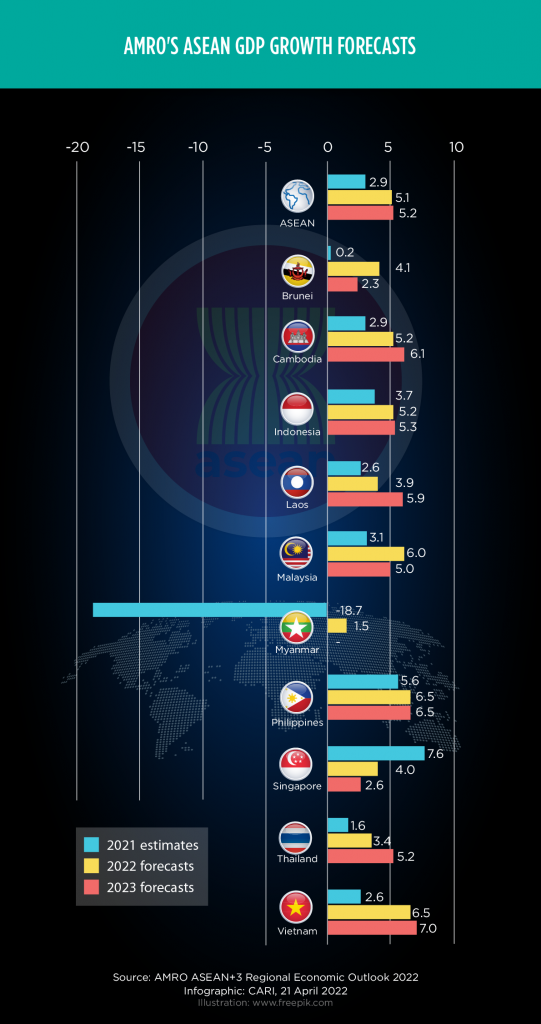

AMRO forecasts 5.1% growth for ASEAN as growth normalises

(18 April 2022) The ASEAN+3 Macroeconomic Research Office (AMRO) expects ASEAN to grow by 5.1% in 2022 and 5.2% in 2023 as the region’s economies move towards a fuller opening up in parallel with their rising vaccination rates. However, AMRO notes that this does not take into account the impact of the Russia-Ukraine conflict since the conflict’s impact on ASEAN remains limited for now. All ASEAN countries, especially the Philippines (6.5%), Vietnam (6.5%), and Malaysia (6.0%), are expected to see firmer growth this year, with Singapore being the only exception where growth is expected to moderate from 7.6% in 2021 to 4.0% in 2022.

INDONESIA

Indonesia’s exports hit an all-time high in March

(18 April 2022) Indonesia’s exports saw a 44.36% year-on-year spike in March 2022, reaching US$26.5 billion, its highest export total ever since the Indonesian government began recording such data in 1993. The country’s imports also saw a 30.85% year-on-year spike to US$21.97 billion and its trade surplus also reached a six-month high of US$4.53 billion. The surge in exports was driven by coal, metals and crude palm oil, while the surge in imports was due to an increase in raw materials and capital goods. This uptrend is expected to continue as Indonesia benefits from increased commodity prices due to global shortages and the Russia-Ukraine conflict.

SINGAPORE

Singapore’s air passenger traffic at 31% of pre-pandemic numbers

(18 April 2022) Singapore’s air passenger traffic reached 31% of pre-pandemic levels and is expected to reach 50% this year, according to the country’s civil aviation agency. The number of passenger flights has also achieved 38% of pre-pandemic levels, with robust growth in traffic volume to and from Australia, Malaysia, Indonesia and Thailand. Meanwhile, Singapore Airlines Group — which operates both Singapore Airlines and Scoot — recorded a nearly nine-fold increase in passengers in March 2022, with passenger capacity reaching 51% of pre-pandemic levels. The group expects this figure to reach around 61% by May 2022.

SINGAPORE

Singapore approves second oral antiviral drug for COVID-19

(19 April 2022) Singapore has approved the use of Molnupiravir, an oral antiviral drug developed by MSD that goes by the brand name Lagevrio, for treating adult COVID-19 patients. According to the government, the drug can reduce the risk of severe COVID-19 by 30% through a mechanism that “causes the machinery that reproduces the virus’s genetic material to make mistakes, thereby rendering the copies defective”. Separately, Singapore’s health ministry said that more clinics would soon be authorised to prescribe Pfizer’s Paxlovid pill — the first oral COVID-19 antiviral drug it approved — for those at risk of severe disease.

CAMBODIA

Cambodia delays capital gains tax to 2024

(16 April 2022) Cambodia has postponed the implementation of its amended capital gains tax to 1 January 2024 to give the private sector more time to recover from the pandemic. Capital gains received by residents and non-residents are taxed at a rate of 20%, with “capital” encompassing immovable property, investment assets, foreign currencies, intellectual property, leases, and goodwill. While the tax is not new, the 2024 version will also apply to individuals buying and selling real estate. Only properties that have served as an individual’s primary residence for five years before the sale will be exempted from the tax.

THAILAND, VIETNAM

Thailand, Vietnam aim for US$25 billion in bilateral trade

(21 April 2022) Vietnam and Thailand have agreed to aim for US$25 billion in bilateral trade by 2025, up from the US$19.5 billion recorded in 2021. Thailand’s exports to Vietnam saw a 12.3% increase last year totalling US$12.5 billion, while its imports from Vietnam grew by 27.6% to reach US$6.93 billion. Vietnam was also Thailand’s sixth-largest trading partner last year, after China, Japan, the United States, the European Union, and Malaysia. The new bilateral trade target was announced following a meeting held between the countries’ trade ministers in Bangkok this week.

ASEAN, UNITED STATES

US government to probe solar imports from Southeast Asia

(18 April 2022) The US commerce department has opened an investigation to find out if the solar products that the US imports from Cambodia, Malaysia, Thailand and Vietnam are actually goods produced in China that are then shipped to Southeast Asia for minor processing and exporting in order to skirt US solar duties. Southeast Asia has been the US’ number one source of solar panel imports for the past five years, with 85% of imports in 2021 coming from the four countries. Separately, the White House announced that the US-ASEAN Special Summit would be held in Washington, DC, on May 12-13.

RCEP Monitor

NEW ZEALAND, SINGAPORE

NZ and Singapore to partner on climate change and green economy

(19 April 2022) Singapore and New Zealand announced that they would further enhance their bilateral relationship through cooperation in several areas, most notably through the establishment of a new “climate change and green economy” pillar under the existing Singapore-New Zealand Enhanced Partnership. This will include working together to develop a sustainable aviation ecosystem focusing on low and zero-emission fuel solutions. The announcements were made on the occasion of Prime Minister Jacinda Ardern’s three-day visit to Singapore, her first official trip abroad since early 2020.

SOUTH KOREA, CAMBODIA

Cambodia-Korea bilateral trade jumps 22.8% in Q1

(20 April 2022) Trade between Cambodia and South Korea grew by 22.8% year-on-year to reach US$234.4 million in the first quarter of 2022. Cambodia’s exports to South Korea saw a 22.2% increase during the period reaching US$61.3 million, while its imports from South Korea rose by 23.1% to reach US$173 million. Cambodia mainly imports cars, machinery, textiles, and agricultural and marine products from South Korea and exports textile-based goods and agricultural products to them. Both countries expect this uptrend to continue with the Cambodia-Korea free trade agreement on the way.

SOUTH KOREA

South Korea lifts most COVID-19 curbs

(15 April 2022) South Korea lifted most of its pandemic-related restrictions on April 18 as it attempts to return to normalcy. The restrictions removed include a midnight curfew on restaurants and other businesses, the 10-person private gathering limit, and the 70% capacity limit at religious facilities. Rallies and other events with 300 or more people will also be allowed. Nevertheless, Prime Minister Kim Boo-kyum said that the indoor mask mandate would likely remain in place for the foreseeable future, though the government will review the outdoor mask-wearing mandate again in two weeks.