CARI Captures Issue 722: Central bank announces that new family of banknotes to be introduced in first half of 2026

Captures has widened its scope to include news related to all the members of the Regional Comprehensive Economic Partnership (RCEP) agreement which was signed towards the end of 2020. Besides the ASEAN Member States, this includes Australia, New Zealand, China, Japan, and South Korea. The other weekly newsletters under CARI, China-ASEAN Monitor and Mekong Monitor will also be consolidated into the Captures newsletter. We hope this new version of Captures will serve you better and look forward to providing a curation of stories relevant to ASEAN and its trading partners.

BRUNEI DARUSSALAM

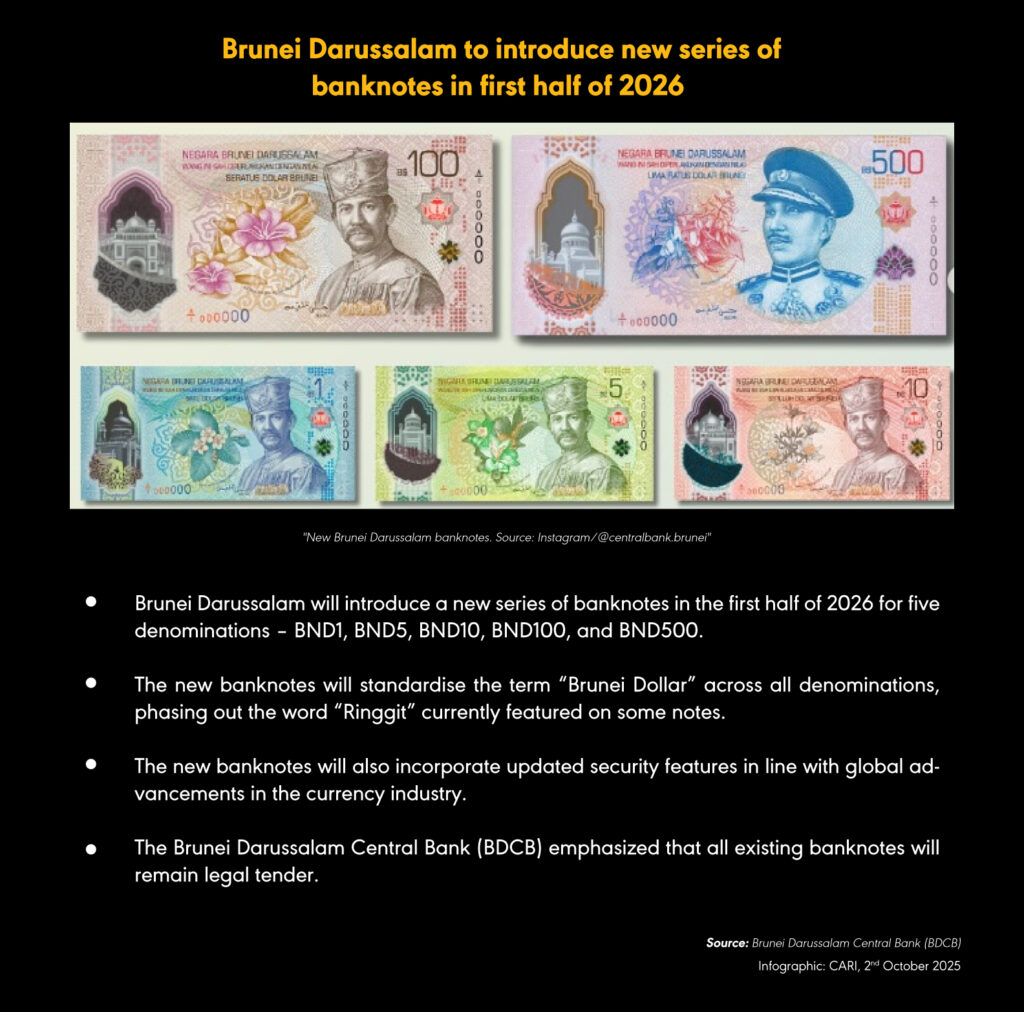

Central bank announces that new family of banknotes to be introduced in first half of 2026

(22 September 2025) Brunei Darussalam Central Bank (BDCB) announced that a new family of banknotes will be introduced in the first half of next year, standardising the use of “Brunei Dollars” in place of “Ringgit” in line with the Currency Order 2004. The series will include five denominations — BND1, BND5, BND10, BND100 and BND500. BDCB stated that the banknotes will carry enhanced security features to strengthen protection against counterfeiting and to align with international standards in currency technology. The central bank emphasised that the initiative ensures currency integrity while supporting Brunei Darussalam’s gradual transition towards a digital economy. It added that all current banknotes will remain legal tender and circulate alongside the new series.

MALAYSIA, CHINA

Malaysia and China to hold preliminary talks on rare earth processing projects

(02 October 2025) China and Malaysia are holding preliminary discussions on a rare earths processing project that would involve Malaysia’s sovereign wealth fund Khazanah Nasional partnering with a Chinese state-owned company to build a refinery in Malaysia, with Beijing prepared to exchange its processing technology for access to Malaysia’s estimated 16.1 million metric tons of reserves. Khazanah confirmed rare earths are among the industries under study but said talks were at an early stage, while Chinese officials have not commented due to the National Day holiday. The refinery, expected to process both light and heavy rare earths, would represent a policy shift for China, which has previously banned exports of processing technology. Potential obstacles identified include concerns over Malaysia’s ability to provide sufficient raw materials, environmental risks, and regulatory hurdles, as mining requires multiple state and federal approvals, with bans on extraction in protected areas. Malaysia prohibits raw rare earths exports, except for a pilot mining project approved in 2022 to establish operating guidelines. China’s willingness to provide technical support was confirmed by Malaysia’s natural resources minister in August, who added that President Xi Jinping had limited cooperation to state-linked firms to protect trade secrets. The proposed joint venture is also seen as a move to counter Australian company Lynas Rare Earths, which already operates a processing plant in Pahang and signed a supply deal with Kelantan in May. A deal would make Malaysia one of the few countries with access to both Chinese and non-Chinese processing technologies.

THAILAND, MALAYSIA

Thailand forecasts 24 percent decline year-on-year in Chinese tourist arrivals in 2025

(01 October 2025) Thailand forecasts about 200,000 Chinese tourist arrivals during the 27 September–8 October Golden Week, a 24 percent decline from 2024, with tourism revenue expected to fall 17 percent year-on-year to THB 9.1 billion. The Tourism Authority of Thailand attributed the decline to persistent safety concerns despite Thailand’s visa exemption, while competitors Malaysia and Viet Nam reported stronger demand due to lower costs and improved perceptions of safety. Outbound bookings from China rose 28 percent this year with international flight capacity up 10 percent, but Thailand did not rank among the top 10 destinations, which included Ho Chi Minh City, Kuala Lumpur, Hanoi, Denpasar, and Singapore. Malaysia registered 1.8 million Chinese arrivals in the first five months of 2025, boosted by visa waivers and tourism campaigns, and expects Golden Week arrivals to at least match last year’s levels. Chinese tourists in Thailand are projected to stay six to eight nights with daily spending of around THB 6,600, primarily travelling from Beijing, Guangzhou and Chengdu, with additional demand from second-tier cities including Shenzhen and Xi’an.

THAILAND

Strong baht impacting exports, tourism, and household spending

(01 October 2025) Thailand’s baht has appreciated over 8 percent against the US dollar this year, strengthening from 34 on 01 January to 31.70 on 09 September before easing to about 32.40, pressuring exporters, tourism operators, and households. Export margins have narrowed, with US tariffs of 19 percent compounding difficulties, while business owners reported reduced competitiveness and uncertainty in long-term contracts. Tourism arrivals fell 7.52 percent year-on-year between January and September to nearly 24 million, with Malaysia the largest source market and China contributing 3.38 million. The Tourism Authority of Thailand expects Chinese arrivals during Golden Week to drop 24 percent from last year’s 262,001, causing tens of millions of dollars in lost revenue for tourism businesses. Prime Minister Anutin Charnvirakul, facing an economy forecast to expand just 1.8 percent in 2025, has pledged stimulus measures to ease household debt, lower living costs, and provide small-business credit. Thailand’s Finance Minister said he asked the central bank to limit baht volatility, rejecting speculation that gold exports were the main driver of the currency’s strength, despite shipments of 88.4 tonnes worth USD 8.73 billion this year. Ratings agencies have downgraded Thailand’s outlook, with factory output contracting 4 percent in August and exports slowing to 5.8 percent growth, the weakest in almost a year. For individuals earning in US dollars, the stronger baht has reduced take-home pay in local currency, further weighing on household consumption.

THE PHILIPPINES

Massive corruption scandal and resultant unrests darkens growth outlook

(02 October 2025) A corruption scandal involving billions of dollars in fraudulent flood-control allocations in the Philippines has triggered mass protests, weakened investor sentiment, and pressured financial markets, with congressional hearings alleging collusion among lawmakers, public works officials, and contractors to divert funds into ghost projects and padded contracts, while audits revealed non-existent or substandard works. Witness testimonies of cash deliveries to politicians have intensified public backlash, leading tens of thousands to protest in major cities since President Ferdinand Marcos Jr. disclosed in July that budgets were being looted. Economists have cut growth forecasts, with Security Bank lowering their second-half estimate to 5.5 percent from 5.8 percent and full-year projection to 5.5 percent, the bottom of the government’s target, while Sun Life reduced their outlook to mid-5 percent and warned growth could drop to 4.3 percent if spending stalls. The peso was Asia’s worst performer in September and the stock index posted its longest losing streak this year as offshore investors retreated, while the central bank cautioned of weaker investment inflows and service exports. Moody’s Ratings warned that prolonged unrest could dampen growth and delay fiscal consolidation, though it maintained that political risk and institutional strength remain broadly in line with peers. S&P Global Ratings projects GDP growth of 5.6 percent in 2025 and 6.3 percent on average over the next three years, supported by investment-grade ratings, corporate tax cuts, and business incentives.

INDONESIA, CHINA

China requests Indonesia to guarantee long-term supply of resources

(01 October 2025) China has formally requested Indonesia to guarantee long-term supplies of crude palm oil (CPO), natural rubber, and edible bird’s nests to meet rising domestic demand, according to Indonesia’s Deputy Agricultural Minister, who said the request was conveyed by China’s Deputy Minister of Agricultural and Rural Affairs. Indonesia recorded a USD 1.77 billion agricultural trade surplus with China in 2024, led by palm oil exports worth USD 2.72 billion, followed by edible bird’s nests at USD 428 million, rubber at USD 363 million, coconut at USD 270 million, and cacao at USD 218 million. The Deputy Agricultural Minister noted that China is seeking supply certainty as its demand for palm oil increases, while Indonesia, the world’s largest producer, is simultaneously expanding domestic use under its biodiesel programme. The country is currently implementing B40, requiring a 40 percent palm oil blend in diesel, with plans to raise this to B50 next year. He added that Indonesia is working to strengthen palm oil productivity to ensure both domestic energy requirements and secure export commitments can be met.

VIET NAM

Property damage from Typhoon Bualoi estimated at VND 8 trillion

(01 October 2025) Viet Nam’s government estimated property damage from Typhoon Bualoi at VND 8 trillion as of 1 October, with nearly 170,000 houses damaged or inundated, at least 29 fatalities and 22 people missing. The storm, which made landfall on 29 September in northern central Viet Nam, caused widespread damage to infrastructure, including roads, schools, offices and power grids, leaving tens of thousands without electricity. More than 34,000 hectares of rice and other crops were destroyed, though no major damage to industrial facilities was reported despite the presence of large factories operated by Foxconn, Formosa Plastics, Luxshare and Vinfast in affected areas. Flooding spread into northern provinces and Hanoi, disrupting flights, train services and forcing school closures, while many homes were inundated. The disaster management agency’s preliminary report underscored severe agricultural and residential impacts but excluded large-scale industrial losses.

RCEP Monitor

CHINA

China launches K visa for foreign science and technology professionals

(02 October 2025) China’s new K visa for foreign science and technology professionals, announced in August and effective 2 October, has sparked intense domestic backlash after Indian media likened it to the US H-1B visa. The scheme, open to STEM graduates of recognised universities and research institutions in China or abroad, as well as those teaching or conducting research, allows multiple entries and longer stays without requiring local employer sponsorship. However, authorities have not clarified whether it permits employment in China, with state media stressing it is “not a simple work permit” and “should not be equated with immigration.” The controversy escalated after concerns were raised online about competition in a weak job market, leading to xenophobic comments, particularly targeting Indian nationals. State outlets including the Global Times and People’s Daily have defended the visa as a tool to attract global talent, positioning China as an alternative to the US, where H-1B fees have risen under Donald Trump. Official statements frame it as facilitating exchanges in education, science, technology, culture, entrepreneurship, and business. The Ministry of Foreign Affairs has promised further details from embassies and consulates, without a set timeline. Experts note that while the visa aligns with China’s broader push to draw in talent as the US becomes more restrictive, its success may be constrained by language barriers, domestic scepticism, and limits imposed by China’s controlled political environment.

NEW ZEALAND

House prices rise 0.1 percent month-on-month in September, first increase in six months

(02 October 2025) New Zealand house prices rose 0.1 percent in September from August, the first increase in six months after a revised 0.4 percent decline the previous month, though values remain 0.2 percent lower than a year earlier, according to Cotality’s home value index. The rebound follows a two-year low in August and coincides with falling mortgage interest rates, now at their lowest in three years after the Reserve Bank of New Zealand cut the official cash rate to 3 percent in August from 5.5 percent in July 2023, with guidance suggesting a possible fall to 2.5 percent by year-end. Despite this, Cotality’s chief property economist cautioned that the September uptick was marginal and unlikely to indicate a sustained recovery, as buyer caution and a high housing supply remain. House prices fell 1.6 percent in the five months to August, and values may remain weak through 2025 amid subdued growth, with the RBNZ projecting a 0.3 percent contraction this year and economists expecting minimal expansion. The economy shrank 0.9 percent in Q2 2025, unemployment is at a five-year high, though improving consumer spending is expected to support a second-half rebound. Cotality added that further mortgage rate cuts could support borrowers refinancing fixed-term loans, with scope for house values to rise more consistently from 2026, though a sharp boom is unlikely given the slow recovery in the economy and labour market.

AUSTRALIA

Household spending rises 0.1 percent in August, below expectations of 0.3 percent growth

(02 October 2025) Australia’s household spending rose 0.1 percent in August, below expectations of 0.3 percent and following a downwardly revised 0.4 percent gain in July, according to Australian Bureau of Statistics data, with annual growth at 5 percent against forecasts of 5.2 percent. The report showed services spending increased 0.5 percent while goods spending declined 0.2 percent, with the largest category falls in recreation and culture and in alcoholic beverages and tobacco, both down 0.9 percent, while airline travel and accommodation bookings increased. ABS noted spending has risen in 10 of the past 12 months, though the August rise was modest. The data add to the case for the Reserve Bank of Australia to resume rate cuts, with economists expecting a move in November and money markets fully pricing one by March, after the central bank held the cash rate at 3.6 percent earlier this week. The RBA’s governor cited stronger-than-expected household consumption supported by real income growth, rising property prices and a tight labour market, with unemployment at 4.2 percent. Household spending, which accounts for about half of GDP, has been constrained by high debt levels, elevated borrowing costs and inflation, though improving incomes have provided support.

|

15 participating countries |

20 chapters |

2.2 billion |

US$26.2 trillion |

28% |

| ASEAN member states, Australia, China, Japan, South Korea, New Zealand | trade in goods and services, investment, intellectual property, e-commerce, competition, SMEs, economic and technical cooperation, and government procurement | combined population, 30% world’s population | combined GDP, 30% global GDP | global trade (based on 2019 figures) |